The Department of Labor uses the USDA NASS Farm Labor survey to develop the Adverse Effect Wage Rate (AEWR) for H-2A purposes. For many years the average wage in the FLS has become the AEWR for the following calendar year. The reason for the AEWR is that in the law that established the H-2A program, it says that the importation of workers shall not have an ‘adverse effect’ on local wages. The agency uses this survey to make sure the wages will not be impacted by bringing foreign workers in and displacing local workers with ‘cheaper’ foreign workers.

The FLS is conducted over the course of a year by the National Ag Statistics Service (NASS). NASS has been collecting this data for many decades. It is not collected for the purpose of use by the DoL and DoL has no influence on how the survey is conducted. It is more targeted (more surveys done) than the Bureau of Labor Statistics (BLS) Occupational Employment Wage Survey (OEWS) in the agricultural community and is ‘thought’ to be a better representation of the ag community as a whole.

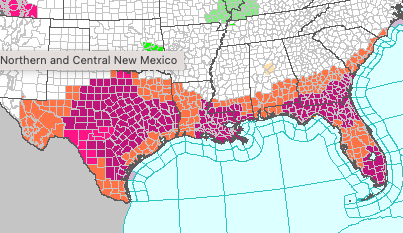

The Survey shows an increase in most Southeastern states of about a dollar per hour (See Table). The new wages will kick in when the DoL publishes them in the Federal Register. This will likely be right at the end of the year. Watch your inbox or keep up with your agent or contractor for exactly when the higher wages are due.

| 2023 | 2024 | |

| Alabama | 13.67 | 14.68 |

| Florida | 14.33 | 14.77 |

| Georgia | 13.67 | 14.68 |

| North Carolina | 14.91 | 15.81 |

| South Carolina | 13.67 | 14.68 |

| Virginia | 14.91 | 15.81 |

We have a lot of problems with just using the FLS as the only means to determine the AEWR. The Farm Labor Survey, as mentioned before was not designed as a survey for AEWR purposes. NASS does not discriminate between H-2A users and non-users. Workers in corresponding employment or neighbors can be influenced by the H-2A wage locally. More H-2A workers are being employed today than ever before. Additionally, the FLS does not take into account any of the other expenses that go a long with the program such as inbound and outbound transportation, housing, meals (in some instances) and in the case of more and more states, overtime for farm workers. While the FLS may capture more workers in ag than the OEWS and may be a better statistical representation of pure wage it does NOT take into account the expense to the employer (effective wage on the employer).

We will have more information as it comes out.

DSF